What is a No-document Loan?

A *no-document loan* is a kind of loan that bypasses the similar old documentation necessities usually expected from debtors.

What is a No-document Loan?

A *no-document loan* is a kind of loan that bypasses the similar old documentation necessities usually expected from debtors. Instead of providing proof of earnings, employment verification, or intensive financial information, lenders evaluate candidates based mostly on different standards. This usually consists of elements corresponding to credit historical past, asset possession, and total monetary behavior. **Such loans serve people who would possibly struggle to furnish typical paperwork, together with self-employed individuals or those with non-traditional earnings sources**. Overall, the attraction lies in the expedited course of and accessibility that no-document loans offer to a broad spectrum of borrow

Challenges Women Face in Securing Loans

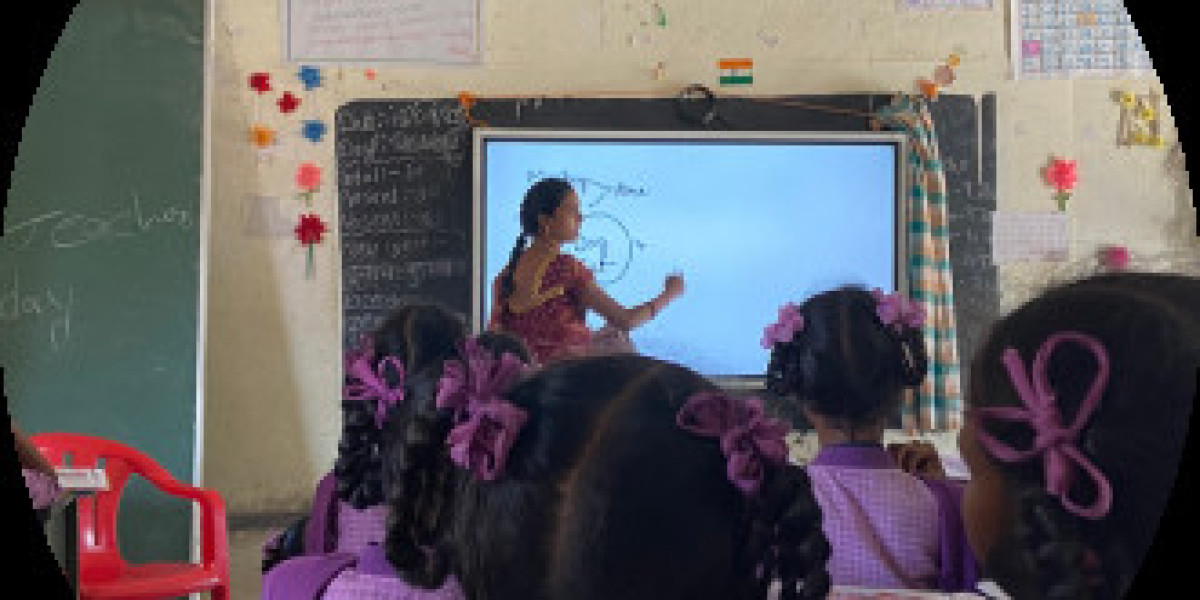

Despite the rising availability of **Women's Loans**, numerous challenges can hinder women's entry to financing. Societal norms and biases often result in difficulties in obtaining loans, no matter a woman's qualifications or monetary standing. Women might face doubts about their capabilities from lenders, impacting their confidence through the utility course

Furthermore, financial education schemes led by employers or external events can empower staff to make knowledgeable decisions relating to loans, ensuring they perceive each the advantages and obligations concer

Another significant problem is the disparity in revenue between men and women. Women, on common, earn much less, which may have an result on their capability to safe larger loans or favorable phrases. Financial institutions would possibly view decrease earnings as a danger factor, leading to problems in the course of the approval course

Most lenders evaluate a borrower's creditworthiness based mostly on their credit score, earnings, and debt-to-income ratio. This analysis helps to discover out the interest rates and phrases of the loan. Since private loans can have larger interest rates than secured loans, it’s important to check offers and perceive the entire cost of borrowing earlier than committ

Before making use of, it can be useful for women to gauge their financial situation, including income, expenses, and any existing money owed. This introspection can aid in determining how a lot funding is needed and what loan products align finest with their monetary objecti

While the minimal credit score requirement varies by lender, most require a rating of at least 600 for personal

Car Loan approval. However, these with higher scores (typically 700 and above) usually safe higher interest rates and terms. It's advisable to examine your credit report and enhance your score earlier than apply

Card Holder Loans are a sort of financing that enables individuals to borrow money against their present credit card stability. This course of usually involves cash advances or specialised mortgage merchandise provided by credit score suppliers. The elementary idea behind Card Holder Loans is to supply quick access to cash, leveraging the

Credit Loan that customers have already got obtainable. Unlike conventional loans that may require intensive credit score checks or collateral, these loans can be obtained via existing credit services, making them accessible for a broader range of peo

Upon submitting your request, lenders might carry out a quick credit assessment, however that is usually less rigorous than traditional mortgage processes. Following approval, funds are sometimes made obtainable nearly immediately, permitting you to handle your financial emergencies direc

One of the first benefits of Card Holder Loans is their accessibility. Reviewing your monetary

Mobile Loan options via your credit card provider can reveal instant borrowing solutions with out intensive paperwork. This makes it a good selection for many who require swift monetary h

Benefits of Personal Loans

There are quite a few benefits associated with personal loans that make them a gorgeous option for borrowers. One of the primary advantages is the pliability of use; private loans can fund just about any expense you may encounter. This versatility is particularly useful for deliberate purchases in addition to unexpected emergenc

Employee Loan Market Trends

The market for Employee Loans is continually evolving, influenced by various financial elements. Recent developments indicate that firms are more and more recognizing the importance of employee monetary wellness and are more prepared to implement such progr

Interest rates for no-document loans can differ extensively, but they usually vary larger than traditional loans as a result of dangers concerned. Borrowers would possibly anticipate rates between 8% to 15% or even larger, relying on their credit Mobile Loan historical past and lender insurance policies. It is crucial to check totally different presents and read all of the phrases earlier than continu

It’s essential to note that while Card Holder Loans current an advantageous possibility for securing quick financial reduction, in addition they come with inherent dangers. Borrowers ought to fastidiously think about the terms and potential charges related to these loans, as they could result in a cycle of debt if not managed responsi

Betting Industry Revolution: Disruption Meets Control in Nigeria's Gaming Sector

Tarafından stanleycarron

Betting Industry Revolution: Disruption Meets Control in Nigeria's Gaming Sector

Tarafından stanleycarron lap đat camera wifi gia dinh chat luong cao gia rẻ thong minh

Tarafından lap camera gia re chuyen

lap đat camera wifi gia dinh chat luong cao gia rẻ thong minh

Tarafından lap camera gia re chuyen Instant Cash for Gold – GOLDX Cash For Gold Best Rates in Pollachi

Tarafından goldxcashforgold

Instant Cash for Gold – GOLDX Cash For Gold Best Rates in Pollachi

Tarafından goldxcashforgold Exploring the World of Ajmer Escort Services

Tarafından nlm7976kumar

Exploring the World of Ajmer Escort Services

Tarafından nlm7976kumar Aviator Game Online: Play And Win Real Money

Tarafından bradlylouden2

Aviator Game Online: Play And Win Real Money

Tarafından bradlylouden2